Volatility smile

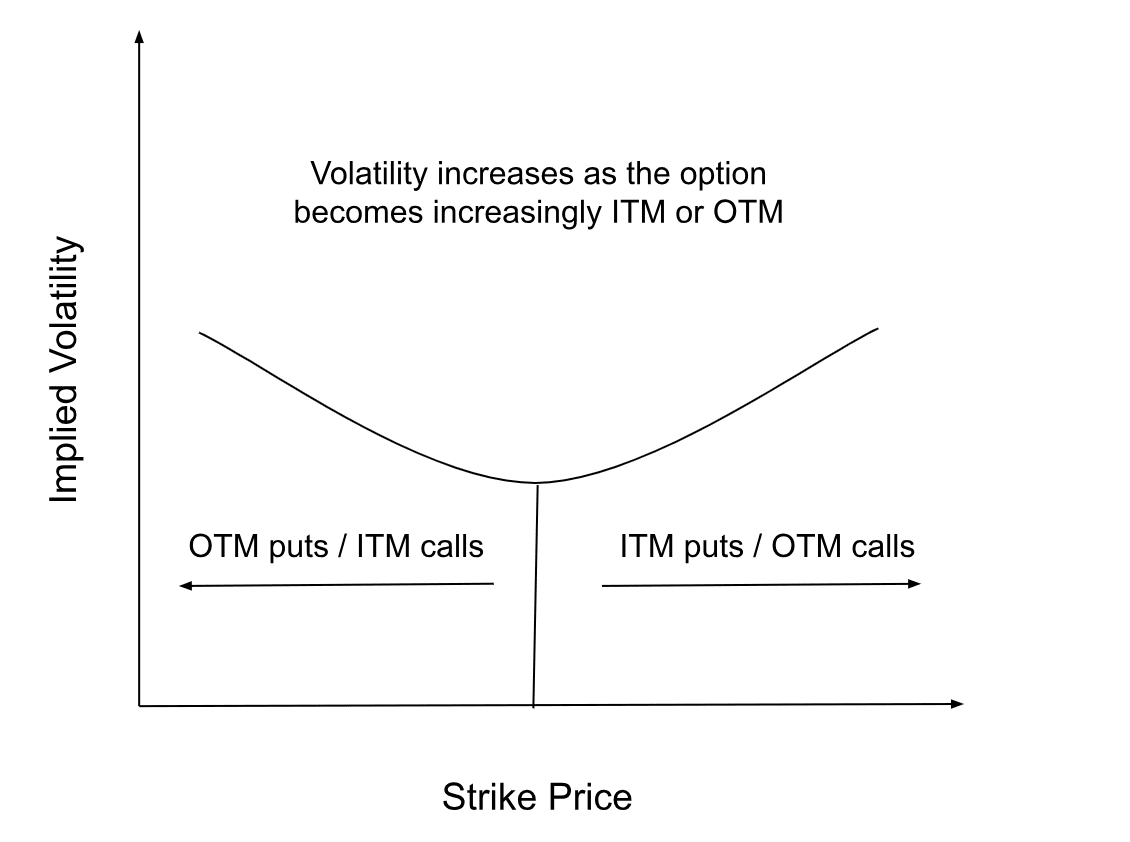

The term refers to a u-shaped graph that depicts the pattern by implied volatilities of options contracts with the same expiration date.

The volatility smile represents a frequently observed graphical pattern that emerges when charting the strike price and implied volatility of a collection of options linked to a single underlying asset and a specific expiration date. This distinctive curve earns its name due to its resemblance to a smiling mouth.

Implied volatility experiences an increase when an option’s underlying asset is positioned either further out of the money (OTM) or in the money (ITM) in contrast to being at the money (ATM). However, it’s worth noting that the concept of the volatility smile doesn’t hold true for all types of options.

Implied volatility shifts, exposing volatility smiles, as the underlying asset moves deeper into the money (ITM) or out of the money (OTM). The extent of implied volatility amplifies for options positioned significantly ITM or OTM. Implied volatility is generally at its lowest when dealing with options at the money (ATM).