X-Efficiency

The term represents the degree of efficiency exercised by companies in an environment of imperfect competition.

Efficiency in this context refers to a company getting the most results from its inputs, including employee productivity and manufacturing efficiency. In a competitive market, companies strive to be as efficient as possible for robust profits and sustainability. However, this is not the case in imperfect competition situations, like a monopoly or duopoly.

X-efficiency refers to illogical actions taken by firms in the market. Traditional neoclassical economics assumed that companies always acted rationally, optimizing production at the lowest costs, even when markets were not efficient. Harvey Leibenstein, a Harvard economist, questioned this assumption of constant rationality and termed it “X” for unknown, or x-efficiency. When there is a lack of real competition, companies may tolerate inefficiencies in their operations. The concept of x-efficiency helps estimate how much more efficient a company could be in a more competitive environment.

When assessing x-efficiency, a common practice involves choosing a representative data point for an industry and modeling it through regression analysis. For instance, a bank could be evaluated based on total costs divided by total assets, yielding a single data point. Then, regression analysis is used to compare data points for all banks, identifying the most x-efficient and determining where the majority lie. This analysis can be applied within a specific country to gauge the x-efficiency of various sectors or across borders for a specific sector, revealing regional and jurisdictional differences.

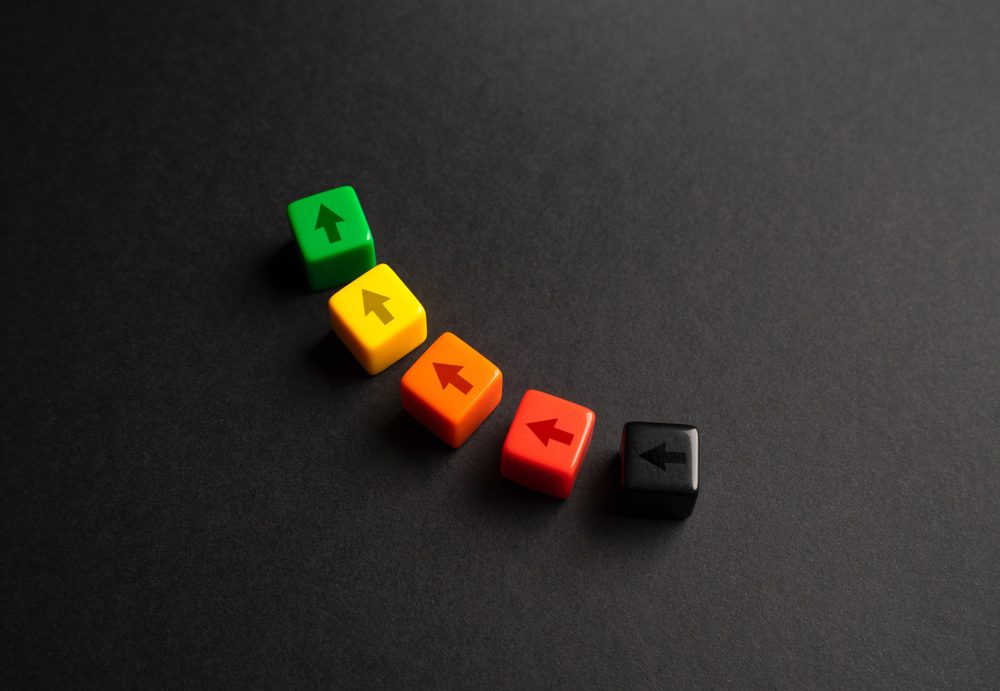

X-Efficiency vs. X-Inefficiency

X-efficiency and x-inefficiency represent the same economic concept. X-efficiency gauges how close a firm is operating to optimal efficiency in a given market. For instance, a firm with a 0.85 x-efficiency is operating at 85% of its optimal efficiency. This might be considered high in a market with substantial government controls and state-owned enterprises. X-inefficiency is essentially the same measurement, but it focuses on the gap between current efficiency and potential. Using the example, a state-owned enterprise in the same market may have an x-efficiency ratio of 0.35, indicating it operates at only 35% of its optimal efficiency. It might be called x-inefficient to highlight the significant gap, even though the measurement itself is still x-efficiency.